- Price is considered range bound when it is not trending up or down.

- We can connect swing highs and lows together to create support and resistance levels.

- Entering a trade with a positive Risk:Reward ratio can tip the odds in our favor.

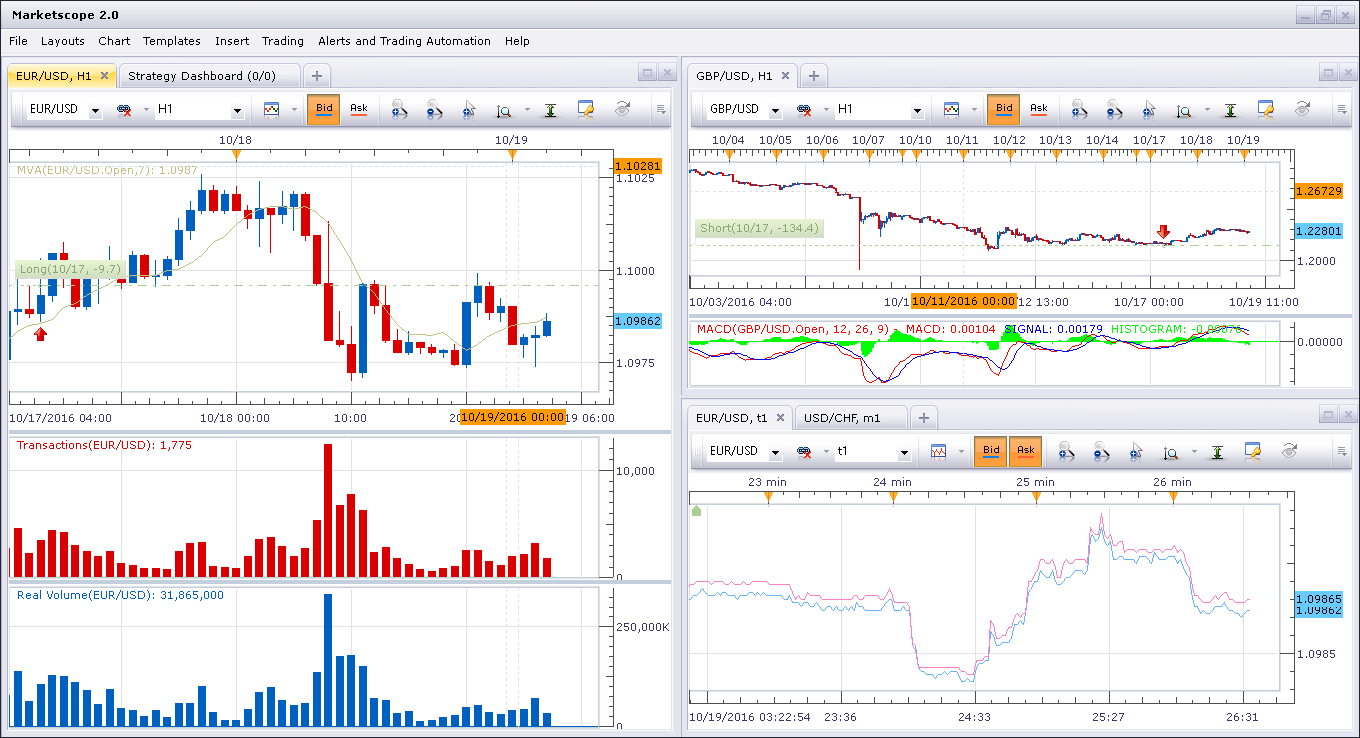

Overview DBFX Marketscope 2.0 is a Shareware software in the category Miscellaneous developed by DBFX Marketscope 2.0. The latest version of DBFX Marketscope 2.0 is currently unknown. It was initially added to our database on. (Created using FXCM’s Marketscope 2.0 charts) Stop and Limit Placement. Traders should always have a plan for managing their position. In the event of a false breakout, traders will wish to exit the market as quickly as possible. For the “ORB-10” breakout strategy, we will again turn to ATR for this task. FXCM Marketscope is a Shareware software in the category Graphics Applications developed by FXCM Marketscope. The latest version of FXCM Marketscope is currently unknown. It was initially added to our database on. FXCM Marketscope runs on the following operating systems: Windows. FXCM Marketscope has not been rated by our users yet. Marketscope Trading From Charts Userguide December 2007 update. Forex Capital Markets, Financial Square 32 Old Slip, 10th Floor, New York, NY 10005 USA. I WWW.FXCM.COM. Free marketscope 2.0 differs from version of download software at UpdateStar. It was originally introduced to Mac users in Mac OS 9. A Windows version has been.

Forex market conditions have been changing over the last couple years. Trend based strategies that worked well in the past are showing mixed results and frustrating many FX traders, myself included. However, recently I’ve been branching out into different strategies that embrace this low volatility environment. Today, we are going to talk about how a range strategy can make sideways markets tradable.Identifying a Sideways Market

Our first step in range trading is to identify currency pairs that are moving sideways. We want to avoid currency pairs with prices that are sloping up or are sloping down. We can target whatever time frame and currency pair that we like, as long as recent price action has been more or less sideways.

The image below is of 3 different currency pairs and their recent price moves. The 1st chart is a classic uptrend, the 2nd chart is a classic downtrend, and the 3rd chart is an example of a range. We want to find charts that don’t have a clear direction and are mostly moving sideways like chart #3.

After we have found a few an examples of a potential ranging pair, it is then time to turn to technical analysis to help us find support and resistance.

Locating Support & Resistance

The terms “support” and “resistance” are trading jargon used to describe price levels where prices have bounced off of in the past. So anytime we see price bounce off a low or bounce off a high, that low and high price can be considered support or resistance.

Identifying these highs and lows is very easy in my opinion. I prefer using a yellow ellipse on my Marketscope 2.0 charts to highlight the times where price has “bounced” from either a high or a low.

Marketscope 2.0 For Mac High Sierra

The chart above shows a USDJPY daily chart with highlighted swing highs and lows. It looks like a mess at this point, but once we connect some of the ellipses together using the line tool, potential trading opportunities can be discovered.

There are differing opinions on how lines should be drawn. I draw lines using a two-step process:

The first step is to identify the highest high price and the lowest low price, and draw a horizontal line extending from each. The highest and lowest prices can act as strong support or resistance.

The second step is to identify price levels that touch more than one ellipse; the more ellipses the better. So in this example, we can see there were a two main clusters of ellipses that were right around the same two price levels. We want to draw a horizontal line through both of those clusters.

The results of these horizontal lines can be seen below.

Standard And Poor's Marketscope

Trading With a Strong Risk:Reward Ratio

Once our lines are in place, we are now ready to place a trade. Since these lines caused price to bounce off them in the past, they may cause price to bounce again in the future. So we want to look to buy when price is approaching a line from above and look to sell when price is approaching a line from below.

It turns out that the USDJPY is right at one of the lower lines that we drew, giving us the possibility of buying at its current level.

Our stop loss should be set beyond the line we are buying at or beyond the lowest low if it is not too far away. Because the lowest low is so close, I’ve opted to set my stop beyond that.

Marketscope 2.0 For Mac Torrent

We want our exit strategy to have a positive risk:reward ratio, meaning we want our profit target (limit) to be further than where we set our stop. This is a key part of money management that can tip the odds in our favor.

Keeping that in mind, we also want to try to place our profit target below the next closest line. This allows price to freely move to our profit target without being hindered by prior support or resistance levels.

Revising Strategy for Ranges

Traders that are fortunate enough to create a winning strategy must never get complacent. Changing market conditions can change your strategies effectiveness, so we need to be able to adapt. Low volatility usually leads to more market ranges, so it is good to know how to trade these types of scenarios.